Introduction

In today’s digital age, mobile wallet apps have become a necessity for millions of users worldwide. With the convenience of carrying money digitally and making transactions on the go, the demand for Mobile Wallet App Development has skyrocketed. Whether you’re a startup or an established business, creating a mobile wallet app can offer significant advantages, from increasing customer engagement to generating new revenue streams.

Recent studies show that mobile payment transactions are expected to reach $14 trillion by 2025, highlighting the immense potential for businesses venturing into this space. However, building a successful mobile wallet app requires careful planning, a deep understanding of the market, and leveraging the latest technology trends.

1. Understanding the Mobile Wallet Ecosystem

Before diving into Mobile Wallet App Development, it’s crucial to understand the ecosystem. A mobile wallet app allows users to store their payment information, such as credit cards, debit cards, and bank accounts, securely on their smartphones. These apps enable users to make payments, transfer money, and even pay bills with just a few taps.

Types of Mobile Wallets:

- Closed Wallets: Linked to a specific retailer or service provider. For example, Starbucks’ mobile payment app.

- Semi-Closed Wallets: Can be used at multiple merchants but within a certain network.

- Open Wallets: Linked directly to bank accounts and can be used for a wide range of transactions, including withdrawals.

Understanding these types will help you decide which model fits your business needs.

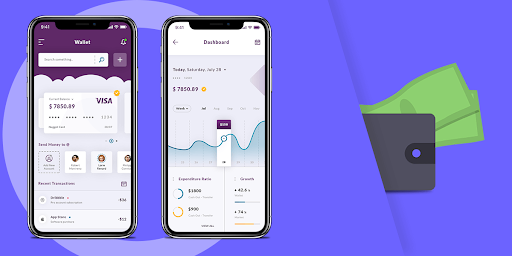

2. Key Features of a Successful Mobile Wallet App

The success of a mobile wallet app largely depends on the features it offers. Here are some essential features to include:

- User Registration and Authentication: Ensure a seamless sign-up process with options like social media integration or email registration. Two-factor authentication is also crucial for security.

- Multiple Payment Options: Support various payment methods, including credit/debit cards, bank transfers, and even cryptocurrencies.

- Transaction History: Users should be able to view their past transactions easily.

- QR Code Payments: This feature is increasingly popular for in-store payments.

- Push Notifications: Keep users informed about their transactions, offers, and updates.

Including these features will not only enhance user experience but also increase the app’s functionality.

3. The Development Process: Step-by-Step Guide

Creating a mobile wallet app involves several steps. Here’s a simplified guide to the Mobile Wallet App Development process:

- Market Research and Planning:

Start by analyzing your target market and understanding the needs of your potential users. Identify your competitors and assess what they offer. This research will help you define your app’s unique selling points (USPs). - Choose the Right Platform:

Decide whether you want to develop for Android, iOS, or both. Consider where your target audience is more likely to be and the cost of development for each platform. - Design the User Interface (UI):

The design should be intuitive and user-friendly. Focus on creating a seamless experience, with easy navigation and clear instructions. Remember, a simple and clean design often resonates best with users. - Backend Development:

This involves setting up servers, databases, and APIs. Security is paramount here, so make sure to implement robust encryption protocols to protect user data. - Integrate Payment Gateways:

Choose reliable payment gateways that support multiple currencies and payment methods. Ensure that they comply with financial regulations and provide a smooth transaction experience. - Testing and Launch:

Before launching, thoroughly test the app to identify and fix any bugs. Beta testing with a small group of users can provide valuable feedback. Once everything is polished, proceed with the official launch on app stores. - Post-Launch Support and Updates:

After launch, continuously monitor the app’s performance. Regular updates and adding new features will keep the app relevant and engaging.

4. Latest Trends in Mobile Wallet App Development

Staying updated with the latest trends is crucial for the success of your mobile wallet app. Here are some trends to consider:

- Integration of AI and Machine Learning: These technologies can be used to offer personalized recommendations and detect fraudulent activities.

- Blockchain Technology: Ensures secure transactions by providing a decentralized ledger.

- Biometric Authentication: Enhances security by using fingerprint or facial recognition for login and transactions.

- Contactless Payments: With the rise of NFC technology, contactless payments are becoming the norm, especially post-pandemic.

Incorporating these trends into your Mobile Wallet App Development process will help you stay ahead of the competition. Also visit 5starsstocks.com.

5. Benefits of Developing a Mobile Wallet App

Developing a mobile wallet app can bring numerous benefits to your business:

- Increased Customer Loyalty: Offering a mobile wallet app can enhance customer loyalty as it simplifies transactions and often includes rewards or cashback programs.

- New Revenue Streams: You can generate revenue through transaction fees, partnerships with merchants, or premium features within the app.

- Improved Customer Experience: A well-designed mobile wallet app provides convenience, speed, and security, significantly improving the user experience.

- Data Insights: Gain valuable insights into customer behavior through transaction data, which can be used to tailor marketing strategies.

These benefits make Mobile Wallet App Development a worthwhile investment for businesses looking to expand their digital footprint.

6. Challenges in Mobile Wallet App Development

While the potential rewards are significant, there are also challenges associated with Mobile Wallet App Development:

- Security Concerns: Ensuring the security of financial data is the biggest challenge. Implementing advanced encryption and following PCI-DSS compliance are essential.

- Regulatory Compliance: Navigating the complex landscape of financial regulations can be daunting. Ensure your app complies with all relevant laws in the regions you operate.

- User Adoption: Convincing users to adopt a new mobile wallet app can be challenging. Offering unique features, ease of use, and security assurances can help.

Addressing these challenges effectively is crucial to the success of your mobile wallet app.

7. Latest Facts and Figures in Mobile Wallet Usage

Here are some recent statistics that highlight the growth of mobile wallet usage:

- As of 2023, there are over 2.8 billion mobile wallet users globally.

- Mobile wallet transactions are expected to exceed $14 trillion by 2025.

- 90% of millennials prefer using mobile wallets over traditional payment methods.

These figures underline the growing importance of Mobile Wallet App Development and its potential impact on the financial industry.

8. Latest News and Industry Insights

In recent news, several major companies have announced plans to enhance their mobile wallet offerings. For instance, Apple Pay and Google Wallet have expanded their services to include more international markets, reflecting the growing global demand for mobile payment solutions. This trend is expected to continue, with more businesses investing in Mobile Wallet App Development to cater to this expanding market.

A quote from industry expert, John Smith, CEO of FinTech Innovations, captures the essence of this trend: “The future of payments is mobile. Businesses that invest in mobile wallet technology today will lead the market tomorrow.”

Best Practices for Mobile Wallet App Design

Frameworks for product designing are required to be chosen according to the app design requirement. Ensure seamless integration with payment gateways and compliance with industry standards. Conduct thorough testing and user feedback sessions to iterate and improve the design.

Conclusion

The future of payments is undoubtedly mobile, and MWallet App Development offers businesses a chance to be at the forefront of this transformation. By creating a secure, user-friendly, and feature-rich mobile wallet app, you can tap into a growing market and reap significant benefits. While challenges exist, the rewards of increased customer loyalty, new revenue streams, and valuable data insights make it a worthwhile endeavor.

As the digital landscape continues to evolve, staying ahead with the latest trends and technologies will ensure your mobile wallet app remains competitive and relevant. Embrace this opportunity, and position your business for success in the rapidly growing world of mobile payments.

Keep visiting nytimer for more informative articles.