Nonprofit organizations operate under unique circumstances, especially when it comes to managing finances. While similar to for-profit businesses in many ways, nonprofits must adhere to specific accounting rules that reflect their mission-driven nature and often tax-exempt status. Proper bookkeeping is critical not only for maintaining compliance with federal and state regulations but also for demonstrating transparency to donors, grant providers, and stakeholders. At Monktaxsolutions, we specialize in nonprofit bookkeeping services, and this guide will help you understand the key principles and best practices every nonprofit should follow.

Understanding Nonprofit Accounting: What Makes it Different?

The financial objectives of nonprofit organizations differ significantly from for-profit entities. The primary purpose of a nonprofit is not to generate profit but to further its mission. As a result, nonprofit accounting uses a fund accounting system rather than the typical profit-and-loss approach seen in commercial businesses. This system allows nonprofits to manage and track the different streams of funds received and ensure they are used for their intended purposes.

What is Fund Accounting?

Fund accounting is an accounting method used to separate resources into different categories or funds based on restrictions imposed by donors or grantors. Each fund is essentially a self-contained entity with its own set of financial reports, including income, expenses, and balances. This allows nonprofits to track funds based on whether they are restricted, unrestricted, or temporarily restricted.

- Unrestricted Funds: These are donations or grants that can be used at the organization’s discretion to fulfil its mission.

- Temporarily Restricted Funds: These are funds given with specific donor-imposed restrictions that must be met within a certain timeframe.

- Permanently Restricted Funds: Donor restrictions require that these funds be maintained in perpetuity, with only the income generated from them used for the nonprofit’s mission.

Managing these different funds requires meticulous tracking and reporting to ensure compliance with legal obligations and donor expectations. Monktaxsolutions has extensive experience in helping nonprofits maintain accurate fund accounting records.

Key Elements of Nonprofit Financial Statements

Nonprofit organizations are required to produce financial statements that are slightly different from for-profit businesses. The most important documents are the Statement of Financial Position, Statement of Activities, Statement of Functional Expenses, and the Statement of Cash Flows.

1. Statement of Financial Position

Similar to a balance sheet in for-profit accounting, the Statement of Financial Position provides a snapshot of a nonprofit’s assets, liabilities, and net assets at a specific point in time. Nonprofits report net assets instead of owners’ equity, which reflects the difference between what the organization owns and owes. These net assets are categorized into unrestricted, temporarily restricted, or permanently restricted.

2. Statement of Activities

The Statement of Activities serves as a nonprofit’s income statement. It shows the revenues and expenses over a specific period, detailing the changes in net assets. This statement breaks down the sources of income (e.g., donations, grants, program revenue) and the related expenses (e.g., program services, fundraising, administration). This report helps nonprofits assess their financial health and sustainability.

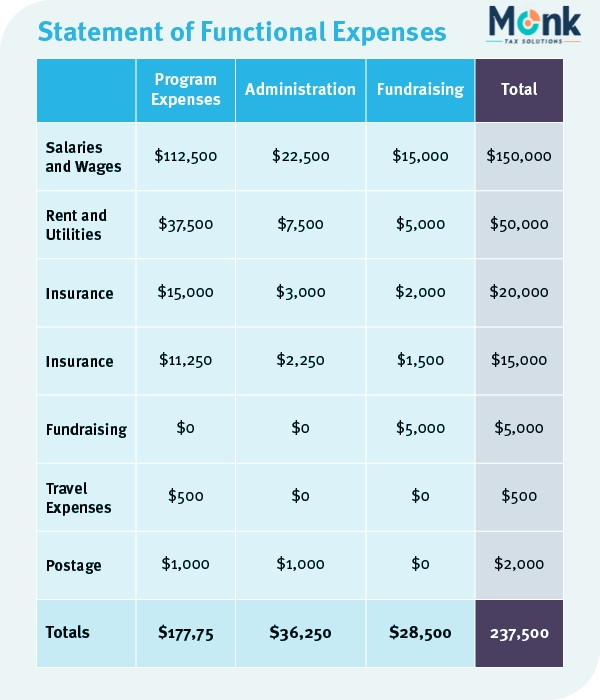

3. Statement of Functional Expenses

One of the most unique aspects of nonprofit accounting is the Statement of Functional Expenses, which categorizes expenses by both their nature and function. This means breaking down costs into categories like program services, management and general, and fundraising. This statement is critical for nonprofits to demonstrate how they allocate their resources toward their mission and is often required by grant providers or regulatory bodies.

4. Statement of Cash Flows

The Statement of Cash Flows tracks how cash moves in and out of the organization. It helps nonprofits monitor cash reserves, operating activities, investment activities, and financing activities. Understanding cash flow is crucial for nonprofits to ensure they have enough funds to cover day-to-day operations and long-term projects.

Best Practices for Nonprofit Bookkeeping

Accurate and transparent financial management is vital for the success of any nonprofit. Here are some best practices that can help you stay compliant and build trust with donors, grantmakers, and other stakeholders.

1. Implement a Robust Chart of Accounts

A detailed and well-organized chart of accounts is the backbone of a nonprofit’s financial system. It should reflect the various income sources, programs, and expenses unique to your organization. A comprehensive chart of accounts ensures that your bookkeeping is accurate and that you can produce reliable financial reports.

2. Track Restricted Funds Separately

As mentioned earlier, nonprofits often receive restricted funds that must be used for specific purposes. It’s essential to track these funds separately to ensure compliance with donor restrictions and legal requirements. Failure to properly manage restricted funds can lead to loss of donor confidence or even legal penalties.

3. Maintain Regular Reconciliation

Regular reconciliation of your accounts, especially bank accounts and fund balances, is key to avoiding discrepancies and ensuring that your records are accurate. Set a schedule, such as monthly or quarterly, for reconciling accounts and resolving any discrepancies immediately.

4. Develop an Internal Control System

Establishing an internal control system is a proactive measure to safeguard your organization’s assets. This includes implementing policies and procedures for approving expenditures, managing cash, and ensuring that financial transactions are properly documented and authorized. It can also involve segregating financial duties among staff to prevent fraud or errors.

5. Adopt Accounting Software for Nonprofits

Using accounting software specifically designed for nonprofits can help streamline your bookkeeping process. Many software solutions offer features like fund accounting, grant tracking, and donor management, making it easier to track finances and generate required reports. At Monktaxsolutions, we can help you choose the right software that suits your nonprofit’s needs.

6. Prepare for Audits

Nonprofit organizations, especially those that receive significant donations or government grants, may be required to undergo an audit. Even if an audit is not required, conducting regular internal audits can help ensure the accuracy of your financial statements and identify areas for improvement. Maintaining thorough and organized records will help you pass an audit with ease.

Common Nonprofit Accounting Challenges

Nonprofits face several unique challenges in managing their finances, and understanding these obstacles is crucial for long-term success.

1. Managing Cash Flow

Many nonprofits rely on donations or grants, which may not always arrive consistently. This irregular flow of cash can make it difficult to cover ongoing expenses. It’s vital to create a cash flow forecast to anticipate shortfalls and ensure that your organization can maintain operations even during lean periods.

2. Compliance with IRS Regulations

Nonprofits enjoy certain tax benefits, but they are also subject to strict Direct IRS Tax Filing regulations. Failing to file required forms, such as the IRS Form 990, can result in penalties or loss of tax-exempt status. It’s important to stay up-to-date with IRS filing requirements and maintain clear records to ensure compliance.

3. Budgeting for Programs

Allocating resources for various programs while maintaining a healthy financial balance can be tricky. Nonprofits must regularly evaluate their budgets to ensure that they are maximizing impact without jeopardizing financial stability. Creating realistic, detailed program budgets is a best practice for achieving this balance.

Conclusion

Accounting for nonprofits is a specialized field that requires attention to detail and a deep understanding of fund accounting principles. By adopting best practices like maintaining separate accounts for restricted funds, using appropriate accounting software, and ensuring regular reconciliations, your nonprofit can achieve financial transparency and stability. Monktaxsolutions provides tailored nonprofit bookkeeping services and expert guidance to help you manage your finances efficiently and in compliance with all regulations.